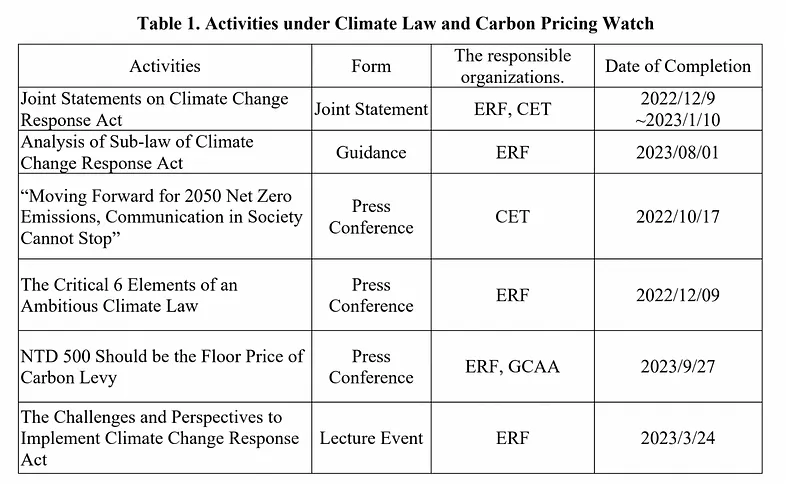

The main objective of this task is to monitor the legislation process of Climate Law Revision to strengthen the climate governance mechanism and promote an ambitious carbon pricing scheme. During the first year of TCAN project, the member organizations held three press conferences,

one forum and formulated two policy analysis reports to engage the authorities, lawmakers, and general public (see Table 1).

With our campaign effort, the Climate Change Response Act passed on January 10th, 2023, made Taiwan the 18th country to have a legally binding net-zero target and authorized the implementation of carbon levy. This report summarized the key activities of this task in the following paragraphs.

During the revision process of the Climate Change Response Act, the critical elements TCAN highlighted are as follows :

- The responsibilities of ministries and committees should be clearly defined in the law to strengthen climate governance.

- A comprehensive carbon pricing scheme design with a transitional period from carbon levy to carbon taxes.

- Considering human rights impacts, prioritize nature-based and community-based adaptation strategies.

- No one is left behind in climate governance, strengthening local governance, transparency, and public participation.

- Ensuring the right for citizen climate lawsuits.

- Nuclear power is not an option for net-zero emission for Taiwan; renewable energy is making significant progress.

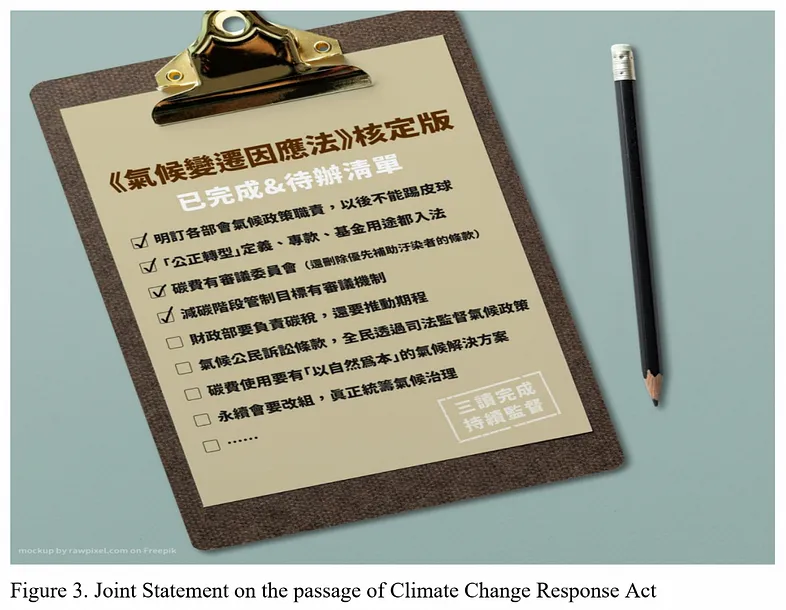

With our campaign effort, the Climate Change Response Act passed on January 10th, 2023, made Taiwan the 18th country to have a legally binding net-zero target. As a series of major amendments to the existing 2015 Greenhouse Gas Management Act, in addition to a more stringent long-term target, the Act also authorizes the implementation of carbon levy, enhances the institutional capacity of adaptation, and establishes the governance structure and budgetary support for just transition. However, this progress is still insufficient to ensure Taiwan’s eventual fulfillment of its climate pledges due to the following key shortcomings.

The years-long campaign of local climate advocates has led to significant gains, such as tightening the criteria for offset programs and limiting the proportion of revenues allocated back to large emitters in the carbon levy design, as well as strengthening the overall climate governance structure by expressly stipulating the responsibilities of each ministry and local governments. But there remain three key hurdles that we couldn’t break. First, an independent advisory body like the Climate Change Committee in the UK failed to be established due to the restrictions of bureaucratic organizational structure. Second, the external cost of emission is only partially internalized through the carbon levy, as the fossil fuel subsidies reform was deleted from the final text due to recent instability in energy prices, while broader fiscal and tax reforms were blocked by the Ministry of Finance. Lastly, climate litigation, which can be a helpful means to hold the government and corporations accountable, was rejected because of the judicial and administrative systems’ unfamiliarity with such types of litigation.

After the Climate Change Response Act passed, TCAN held a public lecture event called “The Challenges and Perspectives to Implement Climate Change Response Act”, to explain the effect and key follow-up issues. The most crucial issue is carbon levy design. In order to accelerate the process of the carbon levy and to maximize its mitigation potential, TCAN further held a press conference to emphasize that the carbon levy rate should be determined by the end of this year to ensure the mechanism can be implemented on time. The carbon levy rate, without preferential rates, is initially imposed at 500 NTD per ton, with a target of increasing it to 3,000 NTD per ton by 2030, progressively raising it each year to uphold intergenerational justice and the “polluter pays” principle.